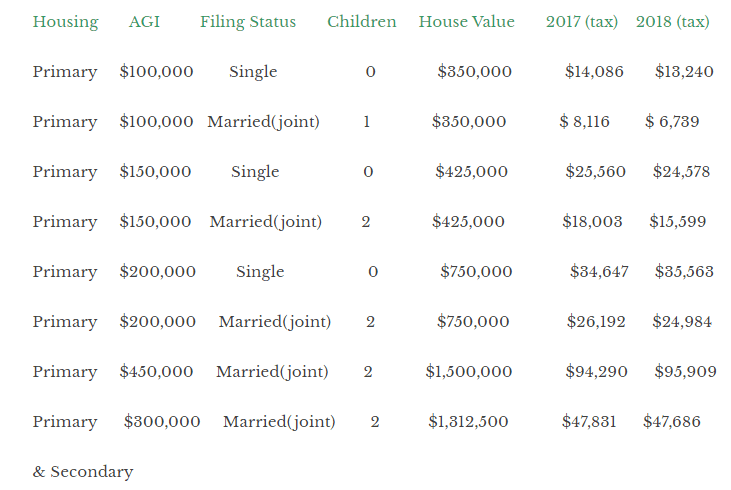

The past month has been vibrant with conversations about the new tax bill, most people had a “salty” view on the topic but somehow, be it intuition or a lucky guess I felt it would all work itself out. As most of you know, I took the week between Christmas and New Year off. In that week I read as many articles as possible on the subject. They went from gloom and doom to slightly hopeful. Quite frankly, last month most of us were a bit confused. Today, I hope to simplify and bring a bit more clarity using REAL examples. Otteau Group LLC collaborated with about a half-dozen accountants (from New Jersey) and demonstrated the calculating effects on taxes in different scenarios.

*AGI (Adjusted Gross Income) * Housing (Housing Situation- Primary Residence and Secondary Residence) * 2017 (tax) – 2018 (tax) Federal Income Tax

We can all argue that this change does not benefit everyone but it’s also not as bad as the predictions we heard in 2017. It is in these events that “WE” (Americans, New Jerseyans) become united, collaborative and creative. This energy will strengthen “US”. Home ownership is not an option it’s a necessity, as such, I am confident the perceived impact as a result of the itemized deduction cap for mortgage interest of $750,000 will not only be offset by lower tax rates but will find itself with a local government solution that will satisfy any minimal loss implied.

My take away:

- It’s not so bad

- Stock Market is holding strong

- Unemployment is at its lowest since 2000

- It hasn’t stopped the purchase of homes, I contracted 2 this week

Looks like we will be just fine!